Embarking on the annual pilgrimage of filing your tax return is a task met with equal parts anticipation and dread. For those navigating the intricate labyrinth of Spanish tax laws, this ritualistic endeavor can feel particularly daunting. The sun-soaked streets of Spain, while welcoming to many, come with their own unique fiscal responsibilities, marked by complexities and nuances that even the most seasoned taxpayer might find mystifying. From the vibrant cities of Madrid and Barcelona to the serene landscapes of Andalusia, every resident faces the inevitable challenge of reconciling their financial affairs with the Spanish tax authority.

As with any journey into the unknown, preparation is key, and knowledge is your most trustworthy compass. Yet, every year, countless adventurers find themselves ensnared in common pitfalls, turning what should be a straightforward voyage into an odyssey fraught with avoidable mistakes. In the quest to demystify this annual undertaking and guide you safely through the treacherous terrains of tax filing, we present to you “11 Mistakes to Avoid When Filing Your Spanish Tax Return”. This guide aims to illuminate the shadowy corners of Spanish tax laws, helping you to sidestep the errors that ensnare many, and ensuring that your financial journey is as smooth and error-free as possible. With this knowledge at your disposal, you can confidently navigate the complexities of the Spanish tax system, secure in the knowledge that you’re fully prepared for the journey ahead. Let’s embark on this fiscal expedition together, armed with the insights and foresight to make this tax season your easiest one yet.

Navigating the Spanish Tax System: Common Pitfalls to Dodge

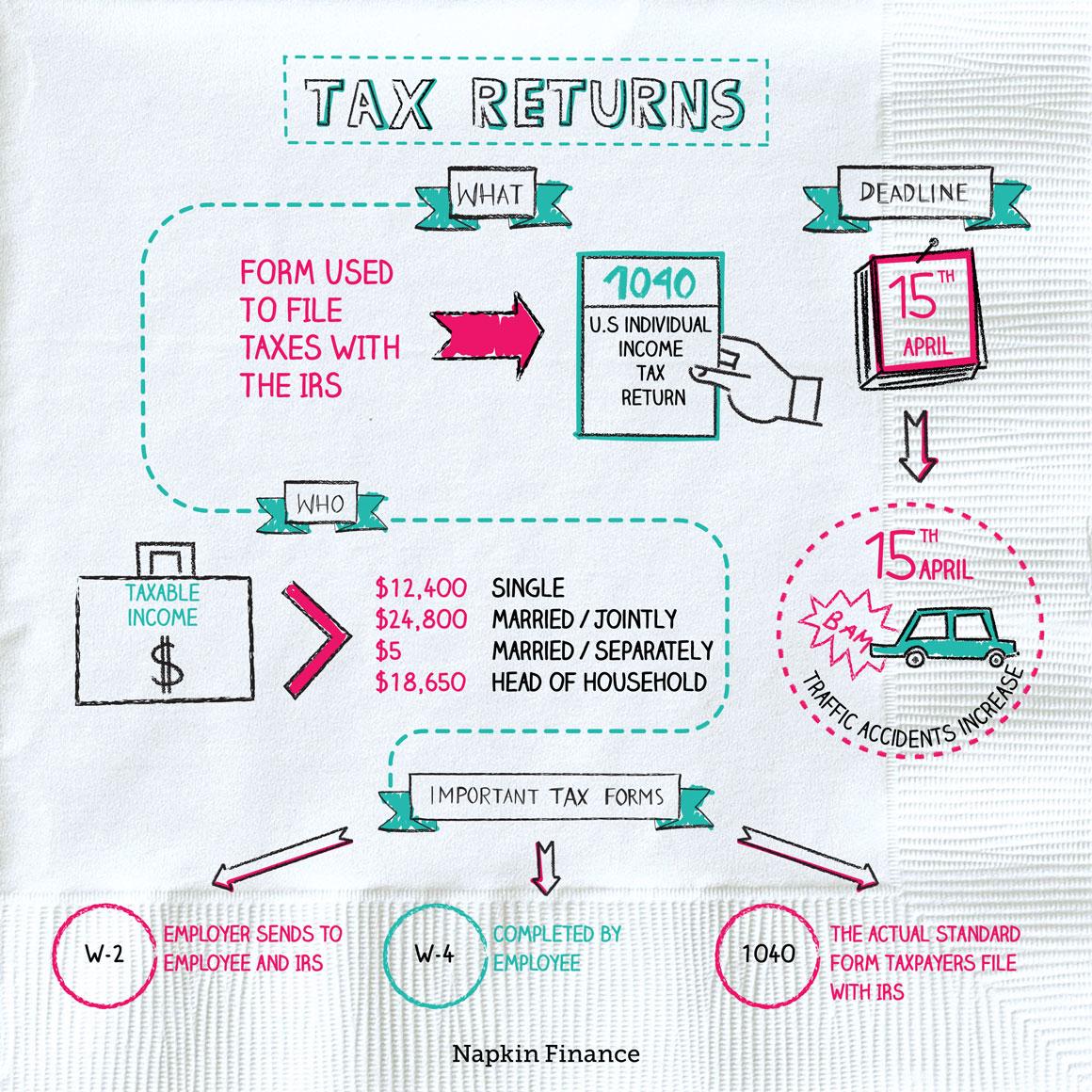

In the labyrinth of tax regulations and deadlines, even the most astute expatriates can find themselves making blunders that cost them dearly. One common misstep is not considering double taxation treaties which Spain has established with numerous countries. If you hail from a nation that has such an agreement with Spain, you might be entitled to certain tax exemptions or relief. Ignoring these treaties can mean paying more tax than necessary or facing legal hurdles for not adhering to the correct tax filing requirements. Another frequently overlooked aspect is underestimating the significance of the Modelo 720 form. This form is essential for declaring any overseas assets over €50,000 and failing to submit it, or submitting inaccurate information, can lead to hefty fines. The complexities of the Modelo 720 form catch many off guard, so thorough preparation and understanding are key.

Moreover, many expats stumble when they do not declare rental income correctly, including those generated abroad, under the presumption that if it’s taxed elsewhere, it need not be declared in Spain. This misconception can lead to unexpected tax liabilities and penalties, as Spain requires the declaration of worldwide income, subject to double taxation agreements. Another pitfall is missing the wealth tax return. Residents and non-residents with significant assets in Spain could be liable for wealth tax, yet many remain unaware of their obligations. It’s crucial to assess your assets comprehensively and understand the nuances of wealth tax to prevent possible fines. Below is a simplified table highlighting some key mistakes and tips on how to avoid them:

| Mistake | How to Avoid |

|---|---|

| Ignoring Double Taxation Treaties | Review the treaty between Spain and your home country and apply for exemptions if eligible. |

| Failing to Submit Modelo 720 | Ensure accurate declaration of all overseas assets exceeding €50,000 by the deadline. |

| Misdeclaring Rental Income | Declare all rental incomes, domestic and international, adhering to Spanish tax laws. |

| Overlooking Wealth Tax | Assess your obligation to file a wealth tax return based on the total value of your Spanish assets. |

Embracing these practices can drastically reduce the chances of falling into common tax pitfalls in Spain, thereby ensuring peace of mind and financial compliance.

The Devil is in the Details: Fine Points that Make or Break a Tax Return

In the labyrinthine world of Spanish tax laws, overlooking the minutiae can lead to the unraveling of what otherwise might have been a flawless tax return. Imagine your tax return as a finely woven tapestry, where each thread represents a detail crucial to the integrity of the whole. A single loose thread, no matter how insignificant it might seem, can compromise the entire fabric. For instance, failing to declare overseas assets could be that loose thread for expatriates. Spain’s notorious Modelo 720 form, which must be filed if you own assets worth more than €50,000 outside Spain, is a common stumbling block. Another often overlooked detail is not applying for deductions you’re entitled to, such as those for large families or investments in environmentally friendly technologies. These are not just minor oversights but significant omissions that can lead to hefty fines or even an audit.

Equally, navigating the shades of gray in tax deductions can be perplexing. Deductions might appear straightforward at first glance, but the devilish detail lies in eligibility and documentation. Take, for example, the deduction for renting your primary residence. Eligibility criteria can differ markedly based on factors such as your age or the property’s location, turning what seemed like a generous deduction into a labyrinthine puzzle. Here’s where diligent record-keeping comes into play. Ensure you keep all relevant receipts and contracts, not just for the current year but also for previous years, as these can sometimes be required to substantiate claims. Below is a simplified table that highlights common pitfalls:

| Mistake | Consequence | Prevention Tip |

|---|---|---|

| Not declaring global income | Potential fines and legal issues | Understand residency rules and declare all income |

| Forgetting about Modelo 720 | Hefty fines for non-disclosure | Review international assets annually |

| Missing out on deductions | Overpaying tax | Research all possible deductions yearly |

| Inaccurate expense claims | Audit and potential fines | Keep detailed records of all expenses |

By keeping an eye on these fine points and preparing your tax return with utmost care, you can navigate the perilous waters of Spanish taxation more smoothly. Attention to detail is not merely about dotting the i’s and crossing the t’s; it’s about understanding the intricacies of tax law and using that knowledge to your advantage.

From Deductions to Deadlines: How to Streamline Your Spanish Tax Filing

Navigating the labyrinth of tax laws can be as daunting as reading a novel in a language you’ve barely mastered. However, the journey from deductions to deadlines doesn’t have to be fraught with peril. One of the cardinal rules is to avoid mixing up your deductions. Errors in deductions can range from claiming ineligible expenses to simply forgetting to include legitimate ones. Remember, not all expenses are created equal in the eyes of the Spanish Tax Agency. For instance, while you can deduct costs related to your rental properties, personal expenses dressed up as business costs will lead to a red flag. To ensure you’re on the right track, maintain a meticulous record of all deductions, cross-referencing them with the latest tax guidelines.

Another area that’s ripe for mistakes is missing deadlines. Think of tax deadlines as immutable as the changing of the seasons; they wait for no one. A delayed tax return not only incurs penalties but also adds unnecessary stress to your life. To streamline this process, mark your calendar well in advance for both the annual tax return deadline (usually by the end of June) and the quarterly VAT declaration dates if they apply to you. Technology can be your ally here; setting reminders on your phone or using tax software that alerts you to upcoming deadlines can make all the difference. And if you’re juggling too many balls and fear missing out, maybe it’s time to consider hiring a tax advisor who can keep track of these crucial dates for you.

| Common Mistakes | Solutions |

|---|---|

| Claiming ineligible deductions | Verify each expense against tax guidelines |

| Forgetting legitimate deductions | Keep detailed records of all relevant expenses |

| Missing deadlines | Set electronic reminders or consider professional help |

By sidestepping these pitfalls, you create a smooth path through the tax season, letting you focus on the more enjoyable aspects of life in Spain. Whether it’s enjoying a siesta without the cloud of tax woes hanging over you or planning your next adventure, knowing your tax affairs are in order brings invaluable peace of mind.

Expert Advice: Proactive Steps to Shield Against Penalties and Audits

Navigating the complexities of tax regulations in Spain requires a strategic approach to avoid common pitfalls that lead to audits or penalties. Engaging with tax experts or legal advisors is a foundational step in ensuring compliance, as their insights can pinpoint potential red flags within your tax return before submission. They offer personalized advice based on the latest legislative updates and your unique financial situation. Ensuring that you maintain meticulous records of all income, deductions, and relevant financial transactions throughout the fiscal year forms a critical part of this advice. These professionals advocate for the use of digital tools and software designed to streamline tax filing processes, thereby reducing the margin for error significantly.

In addition to professional guidance, adopting a proactive stance by educating yourself on Spanish tax laws is imperative. This involves familiarizing oneself with the specifics of deductible expenses, the intricacies of foreign income reporting, and understanding the distinctions between resident and non-resident tax obligations. Experts emphasize the importance of deadlines, underscoring that late submissions are a common trigger for audits and penalties. They recommend setting reminders well in advance of these critical dates and considering early submission to allow ample time for review and corrections if necessary. Moreover, they often suggest double-checking the information against previous years’ returns for consistency and accuracy, as abrupt or significant deviations can raise flags with tax authorities.

| Common Advice | Reason |

|---|---|

| Engage with a tax advisor | Identify and mitigate potential red flags. |

| Use digital filing tools | Minimize errors through automation. |

| Educate yourself on tax laws | Understand your obligations and entitlements. |

| Maintain comprehensive records | Facilitate accurate and complete reporting. |

| Heed filing deadlines | Avoid late submission penalties. |

To Wrap It Up

And there we have it, a navigational roadmap designed to dodge the pitfalls and potholes on the tax-filing journey in Spain. Remember, the path to a flawless tax return is fraught with potential missteps, from missing the ever-important deadlines to overlooking those beneficial deductions that could save you euros aplenty. These eleven mistakes are but spectral guardians, urging caution and diligence as you prepare to submit your financial dossier to the authorities.

Treat this guide not as a mere checklist but as a sage companion whispering wisdom as you traverse the labyrinth of legal obligations and fiscal responsibilities. Each step taken with awareness and precision brings you closer to not just compliance but also to mastering the art of tax filing in Spain.

Whether you’re a seasoned taxpayer or approaching your first encounter with the Spanish tax system, remember, knowledge is the most potent tool in your arsenal. By sidestepping these common missteps, you foster not just peace of mind but also a more prosperous relationship with your finances.

As the sun sets on our discussion, we part with the hope that your journey through the Spanish tax season is less formidable and more favorable. Equipped with these insights, may your tax return journey be smooth, and may the only surprises you encounter be pleasant ones. Happy filing!